Your Property Accounting Specialist🏠🏗️

We specalise in the property sector and work closely with our mortgage advisors & financial advisors to establish your property portfolio making your money work for you. 🏦💰

Morris Accounting also works with clients in a variety of industries. We do not limited ourselves to one sector. We are always open to talking with new businesses about their accounts & how we may be able to help.

If we are not a good fit for your company or tax query we can introduce you to another accounting firm in our network who will be a better fit. 🔁

Have you been feeling overwhelmed with the amount of time you have to dedicate to managing your finances? Do you crave for a judgment-free and personalised approach to accounting? Are you in need of reliable financial and tax advice before it is too late?

If your answer is yes, then we at Morris Accounting, are here to help. A one-to-one financial service tailored around your business.

We work with Individuals, Soletraders, SMEs & Large limited companies.

Hear what our clients have to say about us

“Ive had the pleasure of working with Morris Accounting, and I couldn’t be more satisfied with their services. Highly knowledgeable, professional, and attentive to detail. They take the time to understand the unique needs of my business, offering tailored advice that has greatly improved our financial operations.

They are always responsive, approachable, and willing to go the extra mile to ensure everything is done right. “business”

— Brodie“Worked with Owen really helpful and more importantly very knowledgeable on Xero and accounting best practice. Advice to maximise our tax management invaluable. I will be using these guys as our accountants permanently. Very much value for money. Can only recommend.”

-Chris “Pete was straight talking and very knowledgeable. Trust him implicitly!”

-Oliver“I can't recommend Peter and Owen highly enough. Very responsive, knowledgable and efficient - a needle in a haystack! No job is too big for them.”

-JustinMeet the Team

-

Owen

Director

-

Peter

Director

-

Christina

Junior Accountant

-

Paul

Media Manager

Client Portal 🛡️

Upload documents securely & receive requests and communication via your portal with your dedicated account manager.

Download the app on your app store.

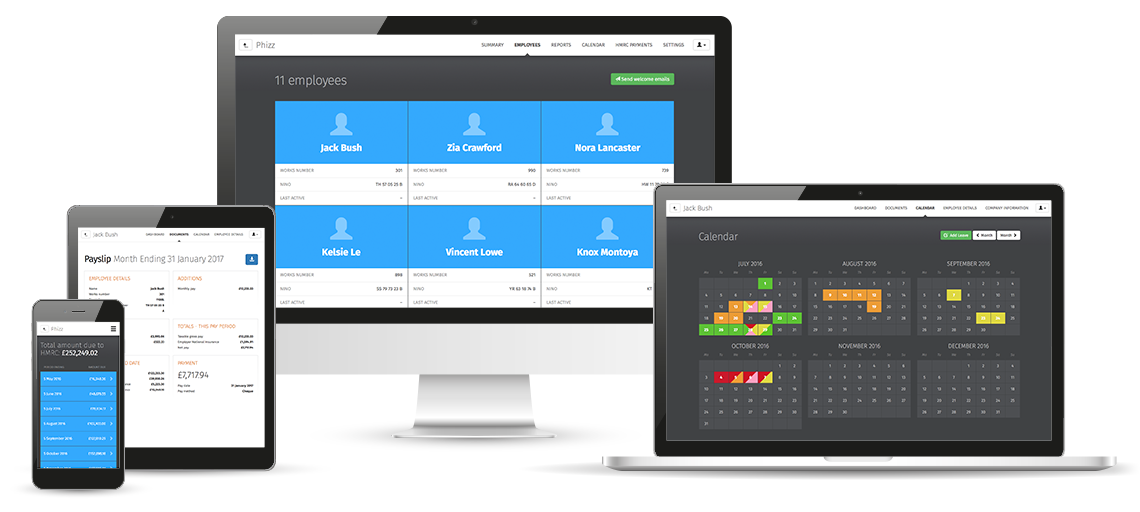

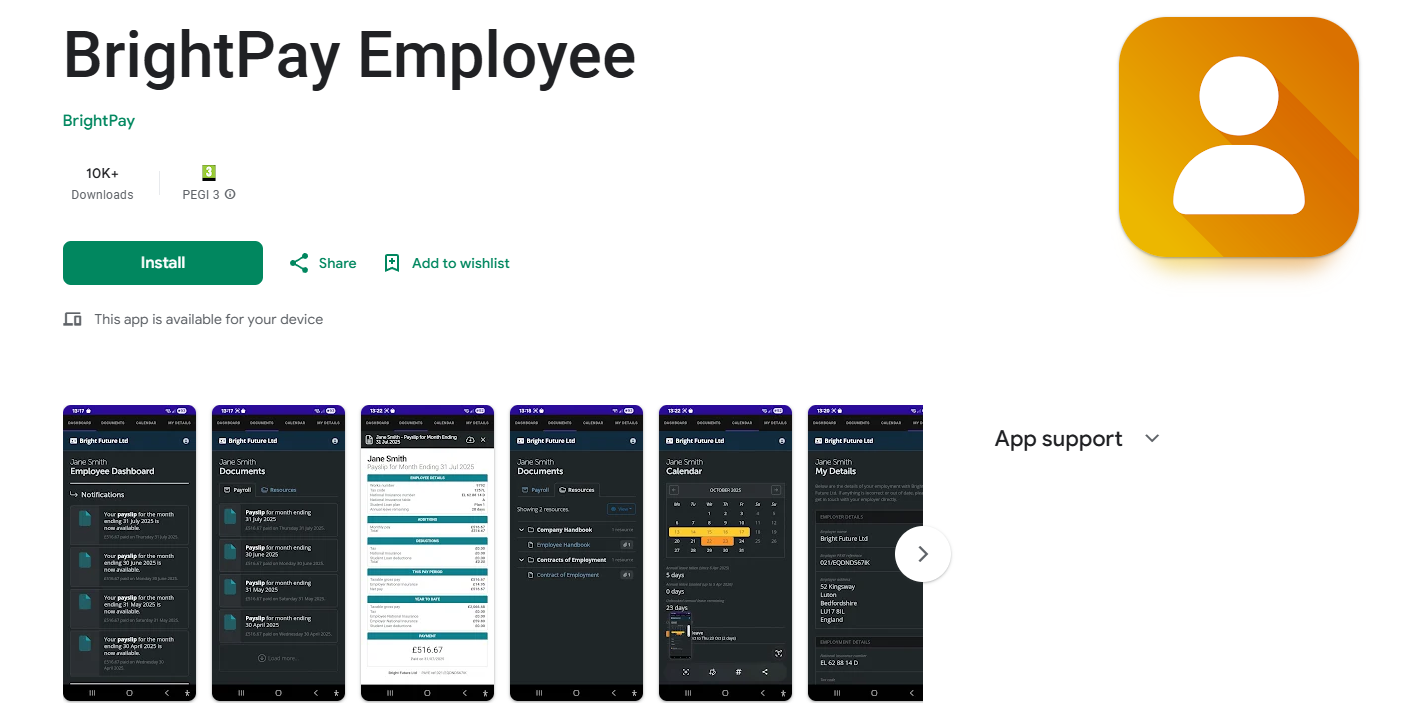

Use your Bright Pay client portal to keep up to-date on the payroll for your employees.

Key Features for the user

Employer Dashboard: You now have 24/7 access to payroll reports, HMRC payment schedules, and a company-wide annual leave calendar.

Employee Self-Service: You can invite your employees to a self-service portal (and mobile app) where they can view payslips, request leave, and update personal details.

Automated Backups: Payroll data is automatically backed up to the cloud every 15 minutes, maintaining a chronological history.

Direct Payments: Through the Modulr integration, you can pay employees without needing to manually upload bank files.

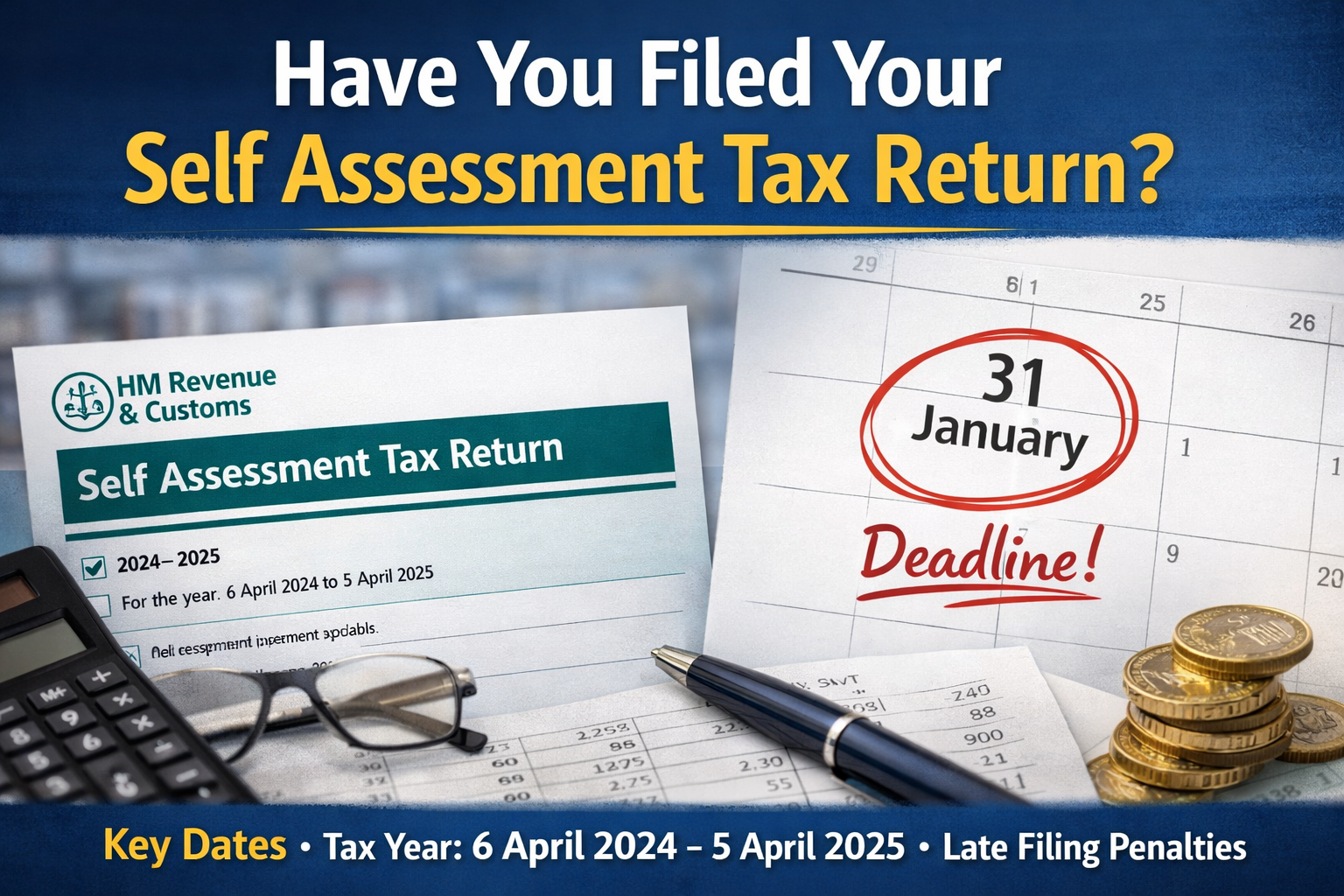

Do you still need to complete your self assessment tax return?

For the 2024/25 UK tax year (ending 5 April 2025), the deadline for filing online Self Assessment tax returns is 31 January 2026. Paper returns were due by 31 October 2025. Taxpayers must register for Self Assessment by 5 October following the end of the tax year, pay any tax owed by 31 January, and file by that same date to avoid penalties.

Key Deadlines for 2024/25 Tax Year (ending 5 April 2025):

5 October 2025: Deadline to register for Self Assessment with HMRC.

31 October 2025: Deadline for paper tax returns.

31 January 2026: Deadline for online returns, payment of tax owed, and payment of any 'payments on account'.

31 July 2026: Deadline for the second payment on account for 2025/26.

Missing the 31 January 2026 Self Assessment deadline for the 2024/25 tax year results in an immediate, automatic £100 penalty, even if no tax is owed. Penalties continue to escalate the longer the return remains outstanding, with daily fines beginning once you are three months late.

2026 Late Filing Penalties

If you miss the filing deadline, the following cumulative charges apply:

1 day late: An automatic fixed penalty of £100.

3 months late: Daily penalties of £10 per day for up to 90 days, reaching a maximum of £900.

6 months late: An additional penalty of £300 or 5% of the tax due, whichever is greater.

12 months late: A further £300 or 5% of the tax due, whichever is greater. In cases where information is deliberately withheld, this can rise to 100% of the tax due.

Late Payment Penalties and Interest

Paying your tax bill late triggers a separate set of charges and interest:

30 days late: A penalty of 5% of the unpaid tax.

6 months late: An additional 5% of the tax still unpaid at that date.

12 months late: A final 5% penalty on any remaining unpaid tax.

Late Payment Interest: HMRC charges daily interest on all outstanding tax from 1 February 2026. As of February 2026, this rate is approximately 7.75% – 8.00% per year.

We help you succeed.

Running a business is no easy task, and managing the finances of a business can be an even greater challenge. That is why, here at Morris Accounting, we strive to help you effectively manage your

business finances, so that you can reach the goals and objectives that you have set out for yourself.

Helplines - HMRC & Companies House

HMRC provides dedicated helplines for specific tax and benefit queries. Most lines are open Monday to Friday, 8am to 6pm, and are closed on bank holidays.

Key HMRC Contact Numbers

Income Tax & PAYE: 0300 200 3300 (General enquiries, including changing your tax code or claiming a refund).

Self Assessment: 0300 200 3310 (Tax returns, registration, and payment enquiries).

National Insurance: 0300 200 3500 (Missing contributions, NI number queries, and general NI records).

VAT: 0300 200 3700 (General VAT enquiries and technical support).

Tax Credits: 0345 300 3900 (Current claims and reporting changes).

Child Benefit: 0300 200 3100 (New claims and general enquiries).

Employers: 0300 200 3200 (PAYE for employers and statutory pay queries).

Online Services Helpdesk: 0300 200 3600 (Technical support for logging in or using HMRC's digital services).

Companies House can be reached for general enquiries, filing, or company information at 0303 1234 500, available Monday to Friday from 8:30 am to 6:00 pm. Alternatively, queries can be emailed to enquiries@companieshouse.gov.uk

Key Contact Information & Support Services:

General Enquiries: 0303 1234 500 (Mon-Fri 8:30am-6pm).

Email: enquiries@companieshouse.gov.uk enquiries@companieshouse.gov.uk.

Accessibility Support (Textphone/Relay UK): 18001 then 0300 373 0995 (Mon-Fri 8:30am-6pm).

Welsh Services Email: UnedyGymraeg@companieshouse.gov.uk UnedyGymraeg@companieshouse.gov.uk.

Webchat/Online Support: Available via the GOV.UK contact page.

Business Support Helpline: For wider business advice, contact 0800 998 1098.

GOV.UK +4

Tips for Calling

Best Time to Call: Phone lines are typically least busy between 8:30am and 11am.

Preparation: Have your National Insurance number or 10-digit Unique Taxpayer Reference (UTR) ready to pass security checks.

Speech Recognition: Most lines use automated software; you will be asked to state the reason for your call clearly.

Extra Support: If you have difficulty using a phone due to a health condition or disability, you can use the Relay UK service by dialing 18001 before the relevant number.

GOV.UK +6

You can also find a comprehensive list of all contact departments on the official GOV.UK contact page.

Agent Helplines

Agent Helpline: 0300 200 3311

Online Services Helpline: 0300 200 3600