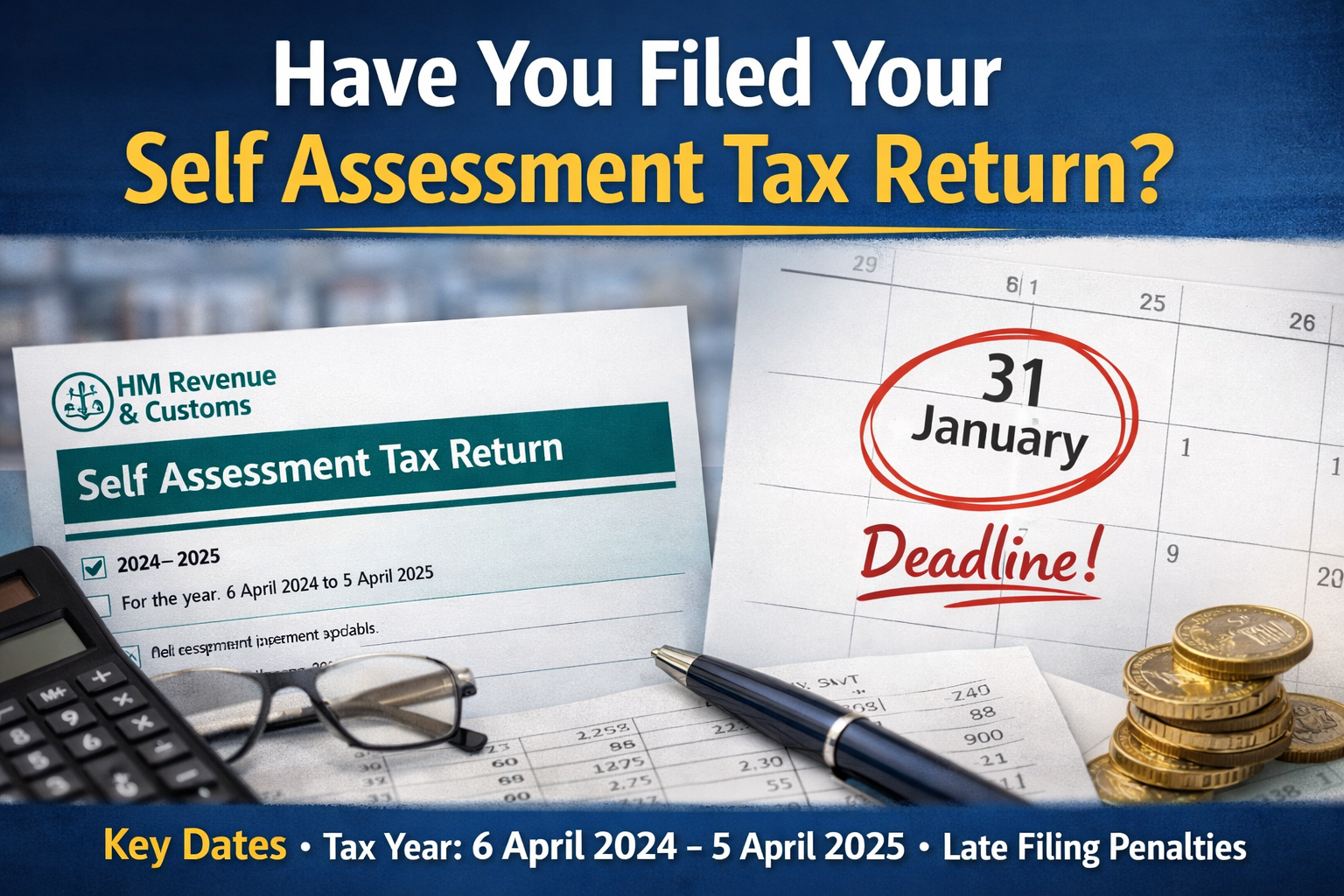

Have You Filed Your Self Assessment Tax Return?

As we move further into the 2026 tax year, it is a good time to remind taxpayers of their obligations under the Self Assessment system. Failing to file on time can lead to unnecessary penalties and interest, all of which are avoidable with early preparation.

This article explains what the Self Assessment tax return for the tax year ending April 2025 covers, when it is due, and what happens if you file late.

What Period Does the 2024 to 2025 Tax Return Cover?

The Self Assessment tax return for the tax year ending April 2025 covers income earned between:

6 April 2024 and 5 April 2025

This includes, but is not limited to:

Self-employed or partnership profits

Rental income

Dividend income

Savings interest not taxed at source

Capital gains

Foreign income

High income child benefit charge

Any other untaxed or under-taxed income

Even if some tax has already been deducted at source, HMRC may still require a return to be submitted depending on your circumstances.

When Is the Self Assessment Tax Return Due?

There are two key deadlines to be aware of:

31 October 2025

Deadline for filing a paper tax return.

31 January 2026

Deadline for filing an online tax return and for paying:

Any balancing payment for the 2024 to 2025 tax year

The first payment on account for the 2025 to 2026 tax year, if applicable

Most taxpayers now file online, so the 31 January deadline is the one that applies in the majority of cases.

What Are the Late Filing Penalties?

HMRC operates a strict penalty regime for late Self Assessment returns.

If your return is filed late, the penalties are as follows:

1 day late: £100 fixed penalty, even if no tax is due

Over 3 months late: £10 per day, up to a maximum of £900

Over 6 months late: An additional penalty of the higher of £300 or 5 percent of the tax due

Over 12 months late: A further penalty of the higher of £300 or 5 percent of the tax due

Interest will also be charged on any tax paid late, increasing the overall cost of non-compliance.

Why Filing Early Makes Sense

Filing your return well before the January deadline gives you several advantages:

More time to budget for any tax due

Earlier visibility of payments on account

Reduced risk of penalties and interest

Time to correct errors before the deadline

Peace of mind

If you are self-employed, have multiple income sources, or are new to Self Assessment, early action is especially important.

Need Help With Your Self Assessment?

If you are unsure whether you need to file a return, or if you would like professional help preparing and submitting your Self Assessment tax return for the year ended 5 April 2025, getting advice early can save time, stress, and money.

If you would like this turned into a more promotional version for your firm’s website or adapted for email marketing or social media, let me know and I can tailor it accordingly